Tax Structures & Accounting for Psilocybin Businesses Understanding 280E

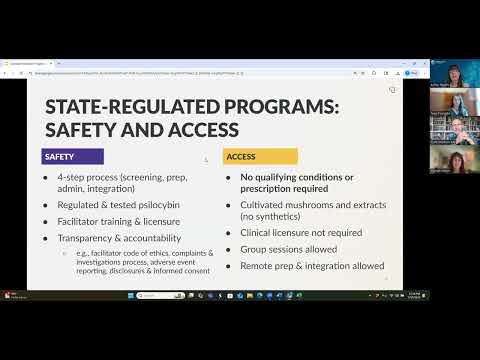

Join an expert panel of accounting professionals for a critical discussion on the unique tax and financial challenges facing state-legal psychedelic businesses and organizations, including cultivators, producers, healing centers, and facilitators.

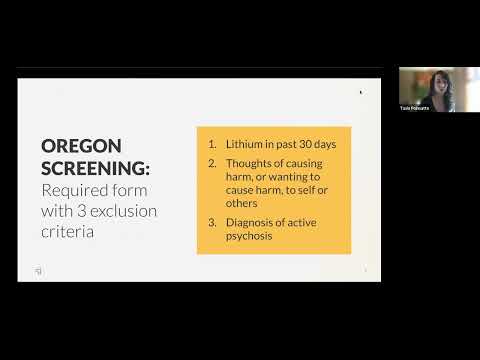

This focused session will provide business owners and licensees in the state-regulated psilocybin programs with foundational knowledge while engaging a deeper analysis of IRC Section 280E of the federal tax code – which disallows normal business deductions for businesses dealing with federally controlled substances. The discussion will highlight strategies for ensuring regulatory compliance and possible impacts on business profitability.

The discussion will be moderated by Sakar Pudasaini, CPA, Partner at Beancount.co, and feature panelists Justin Botillier, Partner & CEO at Calyx CPA and Jordan Cornelius, CPA, CFE, MBA, Managing Member at Cornelius CPAs. The one-hour session will include time for audience Q&A.